The $1,000 balance in the Rent Expense account will appear on the income statement at the end of the month. The remaining $11,000 in the Prepaid Rent account will appear on the balance sheet. The $100 balance in the Insurance Expense account will appear on the income statement at the end of the month. The remaining $1,100 in the Prepaid Insurance account will appear on the balance sheet.

10 Adjusting Entry – Examples

The purpose of adjusting entries is to assign an appropriate portion of revenue and expenses to the appropriate accounting period. By making adjusting entries, a portion of revenue is assigned to the accounting period in which it is earned, and a portion of expenses is assigned to the accounting period in which it is incurred. The adjusting entry for taxes updates the Prepaid Taxes and Taxes Expense balances to reflect what you really have at the end of the month. The adjusting entry TRANSFERS $100 from Prepaid Taxes to Taxes Expense. It is journalized and posted BEFORE financial statements are prepared so that the income statement and balance sheet show the correct, up-to-date amounts.

- The adjustment entry is then recorded in the general ledger using the appropriate accounts and amounts.

- Deferrals involve postponing the recognition of revenues and expenses to future periods.

- Adjustment entries are an important tool for businesses to ensure that their financial statements are accurate.

- You’ll move January’s portion of the prepaid rent from an asset to an expense.

Understanding Labor Costs: Types, Calculation, and Financial Impact

We at Deskera offer an intuitive, easy-to-use accounting software you can access from any device with an internet connection. This is extremely helpful in keeping track of your receivables and payables, as well as identifying the exact profit and loss of the business at the end of the fiscal year. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place.

Prepaid Expenses

Since the firm is set to release its year-end financial statements in January, an adjusting entry is needed to reflect the accrued interest expense for December. The adjusting entry will debit interest expense and credit interest payable for the amount of interest from Dec. 1 to Dec. 31. Adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. An adjusting journal entry is typically made just prior to issuing a company’s financial statements.

Except, in this case, you’re paying for something up front—then recording the expense for the period it applies to. When you generate revenue in one accounting period, but don’t recognize it until a later period, you need to make an accrued revenue adjustment. They can, however, be made at the end of a quarter, a month, or even at the end of a day, depending on the accounting procedures and the nature of business carried on by the company. The company’s accountant needs to take care of this adjusting transaction before closing the accounting records for 2018. Accumulated Depreciation appears in the asset section of the balance sheet, so it is not closed out at the end of the month.

Other methods that non-cash expenses can be adjusted through include amortization, depletion, stock-based compensation, etc. You rent a new space for your tote manufacturing business, and decide to pre-pay a year’s worth of rent in December. First, during February, when you produce the bags and invoice the client, you record the anticipated income. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

The purpose of adjustment entries is to ensure that the financial statements accurately reflect the company’s financial position and performance. Without adjustment entries, the financial statements would not be a reliable source of information for investors, creditors, and other stakeholders. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period.

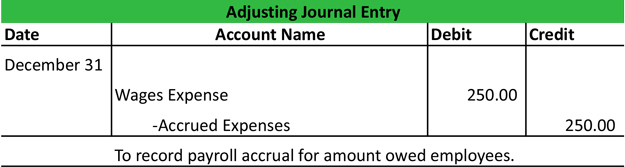

This misalignment can affect both the income statement and the balance sheet, leading to a skewed representation of the company’s financial health. Adjusting entries significantly influence the accuracy and reliability of financial statements, ensuring that they present a true and fair view of a company’s financial position. To record deferred revenue, an adjusting entry is made to decrease the liability plant asset management market account and increase the corresponding revenue account. Accrued expenses are expenses that have been incurred but not yet paid. To record accrued expenses, an adjusting entry is made to increase the expense account and increase the corresponding liability account. It is important to note that adjustment entries are not recorded in real-time and are typically made at the end of an accounting period.

Some transactions may be missing from the records and others may not have been recorded properly. These transactions must be dealt with properly before preparing financial statements. And through bank account integration, when the client pays their receivables, the software automatically creates the necessary adjusting entry to update previously recorded accounts. When cash is received it’s recorded as a liability since it hasn’t been earned yet by the business.