Compliant Loan

A conforming loan try home financing you to conforms to help you constraints place because of the Federal Casing Financing Department (FHFA) and matches new investment criteria off Federal national mortgage association and you will Freddie Mac, government-backed businesses that purchase mortgages of loan loans South Apopka providers, getting balance towards the housing industry.

The brand new FHFA’s 2022 limitations to own compliant funds try $647,two hundred or reduced in the forty eight states and you can $970,800 or quicker to have Alaska and Their state.

Because conforming money meet the recommendations set by Fannie mae and you will Freddie Mac, they generally promote down interest rates and better total conditions than simply non-compliant money.

Non-Conforming Mortgage

A low-compliant financing try a mortgage loan that doesn’t adhere to Fannie mae and you may Freddie Mac’s mortgage constraints and other standards. Jumbo fund, government-recognized money, difficult money financing, interest-simply mortgages and purchase currency mortgages are only some examples off non-compliant loans.

Simple tips to Be eligible for a home loan

- Look at the credit score. The better your credit score, the greater your chances of getting accepted. You can access your FICO Rating ? 100% free as a consequence of Experian. You usually you need a rating out of 620 so you’re able to be eligible for an excellent mortgage, but additional programs can vary. If you need a good chance away from securing a low interest rates, it is best to enjoys a score about middle-700s or more.

- Review their credit reports. Once you’ve an idea of your overall borrowing wellness which have your credit score, review the credit reports when it comes down to advice which you can use to switch your own borrowing from the bank before you apply. You should buy a free copy each and every of credit profile by way of AnnualCreditReport, and score lingering usage of your credit score to own totally free courtesy Experian.

- Opinion your revenue and obligations. As stated, the debt-to-money proportion are a crucial component that loan providers believe. Your suggested houses payment is essentially getting just about twenty eight% of the month-to-month gross income, and your full expenses should remain below 43% in most cases.

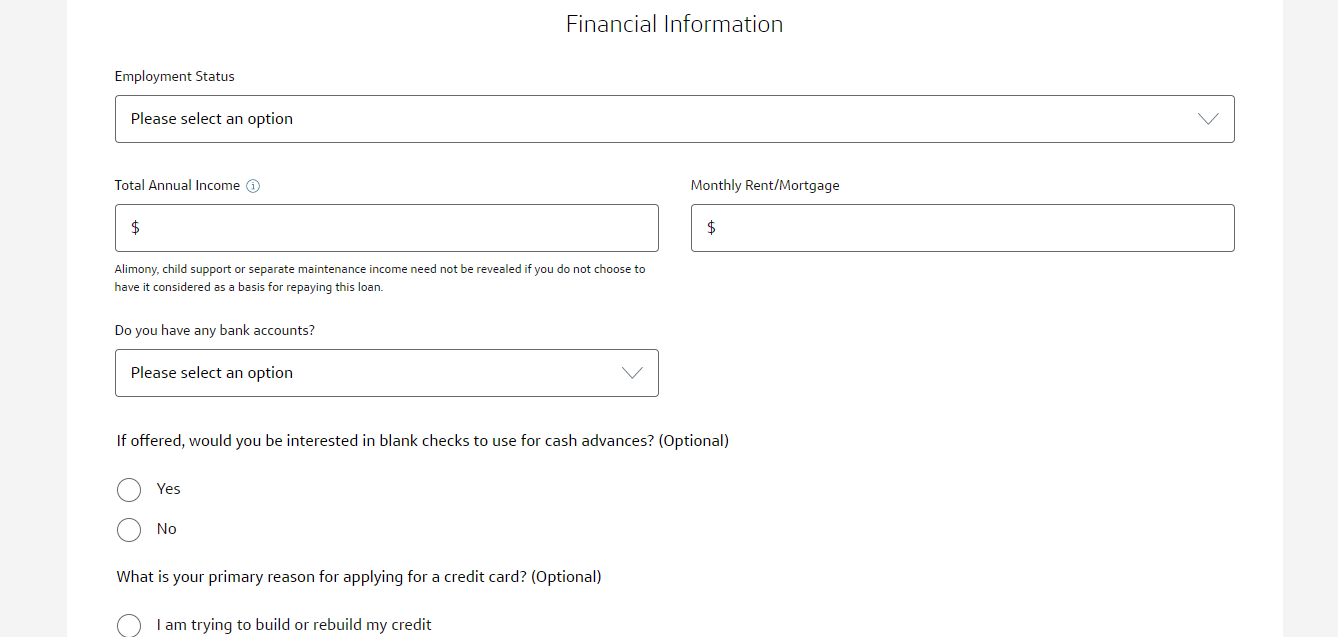

- Submit an application for preapproval. Immediately after you may be happy to implement, you can buy become that have a bank, credit connection, on the web financial or large financial company. Home financing preapproval depends on a loan provider to point new amount you might obtain, the kind of loan in addition to interest rate that you would almost certainly qualify for. Home financing preapproval isnt genuine acceptance, even if. It’s just a file you to definitely claims the financial institution believes it would agree home financing app according to the money and you will borrowing from the bank guidance filed. What needed for a home loan preapproval generally speaking boasts individual information just like your credit rating, credit history, earnings, possessions, debts, tax statements and you will a career background.

- Contrast also provides. It is preferable to search around and you will contrast mortgage conditions away from about less than six mortgage brokers. This process gives you enough information for the best readily available offer to you.

- Fill in the application. Once you’ve decided on a lender, fill out a proper application. You’ll generally speaking need certainly to provide certain data files to verify your earnings, work or any other facts. The faster you operate with your data files, the new less the procedure is certainly going.

- Prevent applying for the latest credit. For some weeks before you apply having a mortgage and you will during the the loan processes, its crucial that you end applying for the newest borrowing from the bank. Not only will it impact your credit score, but taking up an alternative loans will additionally enhance your DTI, both of that can connect with the eligibility.

- Get ready for closure. From the procedure, your loan manager otherwise representative often guide you through the techniques. Soon just before closing, the financial institution have a tendency to generally speaking manage a last credit check and offer you with disclosures or any other records. Make sure to read through that which you very carefully and you can go back closed duplicates promptly to quit waits. Within closure, you are able to complete the processes with increased records while having your own keys.