Including mortgage loans, vehicle fund is protected. The latest collateral, in this case, is the automobile under consideration. The lending company increases the quantity of the purchase price to the seller-quicker https://paydayloanalabama.com/phenix-city/ people down repayments created by the new borrower. New debtor must conform to the brand new terms of the mortgage, and and work out regular repayments till the mortgage is actually paid-in complete. Commonly, car dealerships or the vehicle manufacturer will give so you can serve as this new lender.

Debt consolidation Mortgage

Consumers can be consolidate almost all their expense with the you to definitely from the dealing with good financial to have a debt settlement loan. If while acknowledged, the lending company pays off all the debts. Rather than multiple repayments, the fresh new borrower is only responsible for one to typical fee, that’s built to the newest lender. Really debt consolidation loans is actually unsecured.

Home improvement Financing

Do it yourself finance might not feel protected from the security. In the event the a resident needs to make repairs, they’re able to strategy a bank or other lender to possess an excellent loan and also make renovations that probably improve the worth of their residence. Loans to own things like establishing a swimming pool will usually feel unsecured and get a high rate.

Student loan

This is exactly a familiar particular loans accustomed fund licensed educational expenses. Student loans-also referred to as informative finance-are supplied owing to government or private financing apps. When you find yourself government money are usually considering you prefer, personal money usually believe in the income and you will credit history out-of brand new student’s mothers rather than the pupil on their own-but it’s the fresh new pupil who’s guilty of cost. Repayments are usually deferred since student attends college and the original 6 months immediately following graduation.

Team Financing

Loans, also known as commercial financing, is unique borrowing from the bank points given to short, average, and large organizations. They are always buy significantly more index, hire group, keep day-to-time surgery, pick a house, or perhaps as an infusion away from investment.

What’s a credit line?

A credit line functions in another way from financing. When a debtor is approved to have a credit line, the lending company or financial institution enhances all of them an appartment borrowing limit that the person may use over and over again, the or even in part. This makes it a great rotating credit limit, that is a much more versatile borrowing from the bank device. Particular lines of credit may become accordion has actually that allow access in order to enhanced amounts of funding. As opposed to finance, personal lines of credit can be used for people purpose-out-of everyday orders in order to special costs, instance travel, short home improvements, otherwise paying down large-focus personal debt.

An individual’s credit line operates like a charge card, and perhaps, such as for example a bank checking account. Similar to a charge card, some one can access this type of money whenever they you desire all of them, so long as new account can be time there has been credit available. Like, when you yourself have a credit line which have an excellent $ten,000 restriction, you need region or it-all to possess whatever you need. For those who hold a great $5,000 balance, you could potentially nonetheless utilize the remaining $5,000 any time. For many who pay off new $5,000, you might supply the full $ten,000 once again.

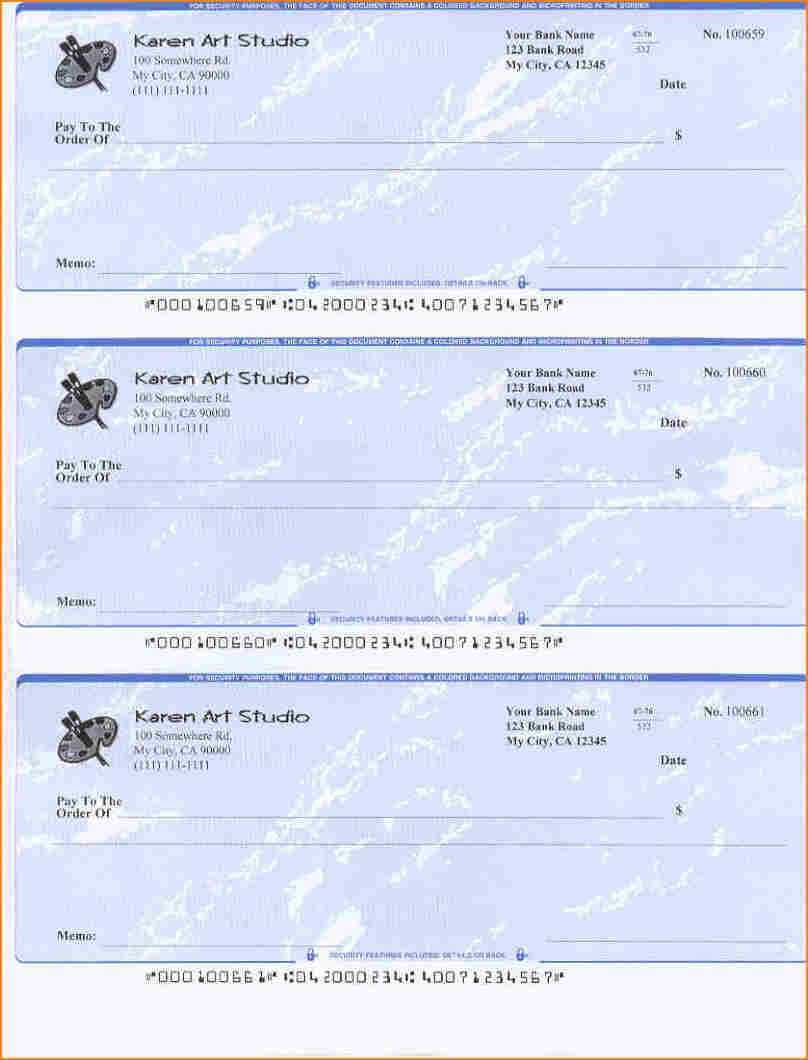

Specific personal lines of credit and additionally function as examining membership. This means you possibly can make instructions and you will costs having fun with a connected debit cards or write monitors contrary to the membership.

Credit lines generally have higher rates, down dollars wide variety, and you will reduced minimal commission wide variety than just funds. Money are needed monthly and are usually comprising each other principal and you may appeal. not, lines of credit generally speaking carry down rates than simply credit cards to have consumers which have a good credit score.