What’s a credit rating and how does it connect with my personal financial rate?

Among the first issues I listen to out-of earliest-go out homebuyers are Does my credit score really apply at my personal mortgage application? No matter if it is singular element of your own home loan lender’s decision, it is a significant one to. Your credit score has a primary effect on the financial attention price, that it issues you might say you could potentially matter for the bucks and you will cents.

In order to top know credit scores and how they grounds into mortgage loan processes, I have waiting a short Q&A beneficial.

What is a credit rating?

Anyone tend to confuse a credit history and a credit file. They are a couple something different. Your credit score is computed based on the recommendations in your credit file. Increased score shows a better credit rating, which will make you eligible for down interest levels.

Just how is my credit rating computed?

Your credit score is determined frequently towards FICO rating design that’s produced by what on your credit file, which happen to be published by credit scoring organizations. Your own reports were a track record of their commission habits having borrowed money.

Very mortgage brokers consider score regarding every three significant credit revealing enterprises Equifax, Experian, and you will TransUnion and make use of the guts rating to own choosing just what rates to offer your.

What exactly is sensed a high credit history?

Credit ratings start from 300 850, that have higher becoming finest. Fundamentally a get off 720-750 or over can get you an informed interest rates.

For those who score on the 720 or a lot more than, you may be ranked because advanced level. As you move down into 700, the score is known as a good. A get from 680 is considered mediocre. Should your rating is actually closer to 640, then you might have trouble bringing a conventional mortgage.

Whether or not your get is lower than 680, you can be eligible for specific funds available for first-day homeowners otherwise reasonable-to-modest money consumers. Find out more in the men and women into the A home loan Boutique’s site.

Ought i get a home loan in the event that my personal credit history is not regarding the advanced or a good ranges?

Sure. Indeed, specific financing software are specially available for people that don’t have the best results. Getting an authorities-insured FHA financial, you happen to be in a position to provides a rating only five-hundred. Va fund don’t require at least FICO get, even though a get off 620 or maybe more is recognized as favorable from the loan providers. Outlying invention finance constantly need a minimum score off 640. Learn more about this type of mortgage loans.

How does my credit rating affect my interest?

And additionally a low personal debt-to-earnings ratio and you can a powerful credit history, you want a premier credit rating to obtain the lowest financial cost. As opposed to a premier credit rating, you simply will not qualify for a knowledgeable financial costs offered, that will imply you’ll be paying more money along the identity of one’s home loan.

If I’m to purchase a house which have a wife or partner, will each other the fico scores end up being factored with the lending decision?

Yes. Even although you is revealing profit, each other fico scores might be taken into account if you together sign up for financing otherwise financial. To be certain each other fico scores are higher, lovers is to work together to save newest profile paid down timely and reduce your current obligations loads.

How do i consider my personal credit history?

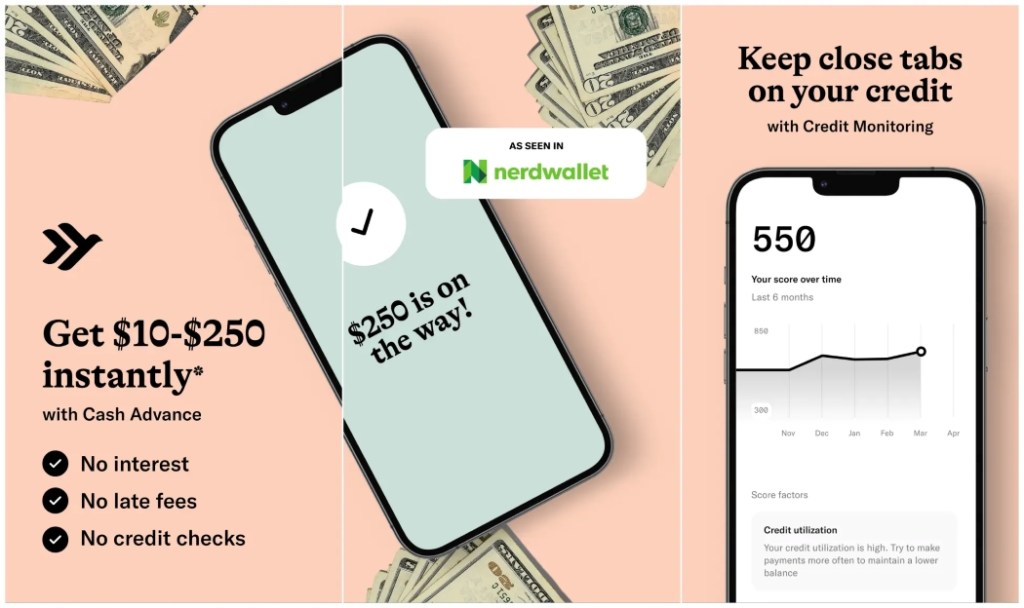

Keeping track of one another your credit score and you may credit rating helps you remain monitoring of your borrowing wellness, so you will know for those who have situated adequate borrowing from the bank to make use of having a home loan. And additionally, normal monitoring will give you the opportunity to hook completely wrong otherwise deceptive information.

The fresh Fair Credit reporting Operate (FCRA) needs each one of the three credit bureaus to provide consumers that have that 100 % free credit report a-year. To truly get your 100 % free reports, visit AnnualCreditReport. These records, however, dont tend to be a credit rating.

When you discover home financing organization like A mortgage Boutique, your residence mortgage coach helps you influence a far more direct FICO credit history – the get in fact it is familiar with qualify your to own a good mortgage. You need some thing in regards to the pre-certification mode here?

How do i boost my personal credit history?

Build into the-big date repayments, together with rent, playing cards, and car loans. Keep your purchasing so you’re able to no more than 29% of your restrict into the credit cards. Lower high-equilibrium credit cards. Look for any errors on your credit file and you will really works on the fixing all of them. Work on a card therapist otherwise a loan provider to build your own credit.