Two times as of a lot payday loans recipients run Walmart compared to another most common business, Kaiser

Payday loan can be used by the individuals who you prefer currency timely, who usually have no other way out of borrowing from the bank money to cover an urgent debts. The benefit of these loans is that they assist you to meet up the immediate financial obligations. The danger, however, is that you was using up loans and you can incurring upcoming debt you to wanted upcoming money to fulfill.

On this page, we shall become familiar with the use position of people that accept pay day finance. Perform he’s got jobs that will enable these to pay-off the newest fund in a timely fashion or will they be cornering on their own toward an amount of personal debt with no income in order to actually pay back this new loans?

At the LendUp, we provide money to the people to fund unforeseen expenses or whenever needed the money prompt. Due to the several years of underwriting financing and working with this customers, we understand a lot regarding financial background your mortgage recipients.

Inside investigation, we’re going to comment the details into the employment attributes away from Us americans exactly who turn to cash advance. Just how many people who check out payday loans has services? Will they be functioning complete-some time and where perform it works?

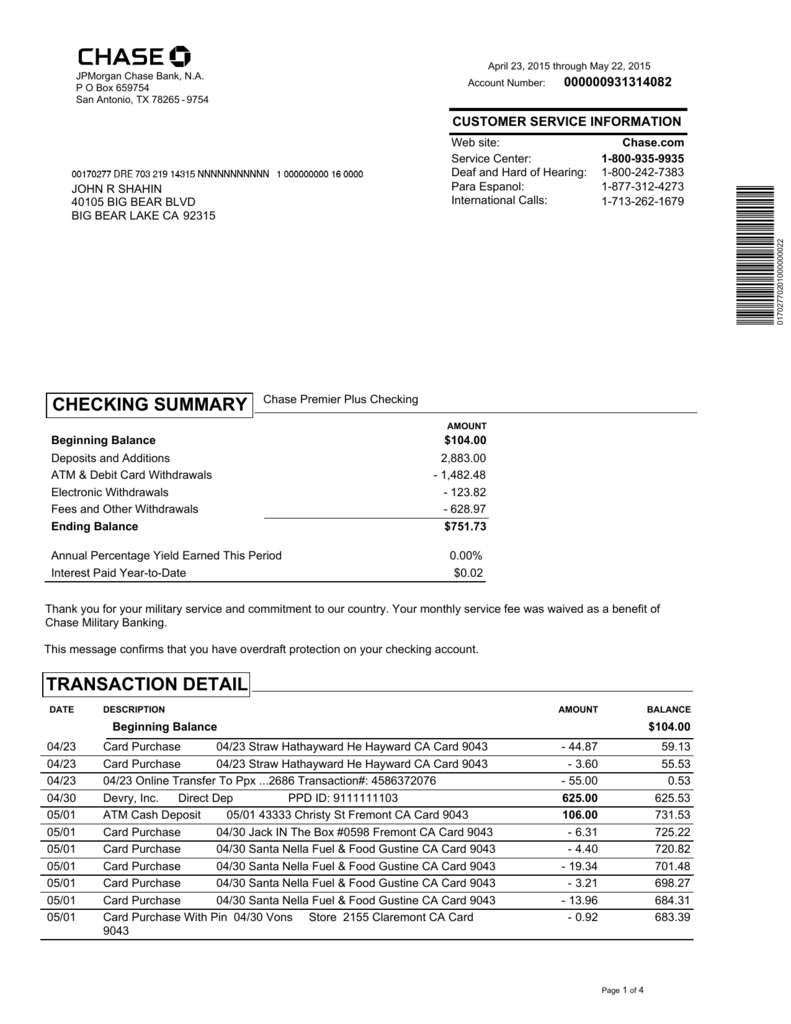

We learned that the newest daunting majority of pay day loan recipients (81.2%) enjoys fulltime jobs. After you are the quantity of readers that work area-day or are actually retired, you to accounts for over 90% away from receiver. Most frequently, payday loans recipients work in conversion process, workplace, and medical care assistance. The preferred boss from LendUp pages whom find a pay day financing is Walmart, followed by Kaiser, Address and you can Household Depot.

Within our loan application process, we query consumers to state its a position updates and newest employer. For this studies, i analyzed money out of 2017 so you can 2020 to loans Knollcrest CT see more popular a career status, marketplace and employers. The information is actually out-of says in which LendUp already works (WI, MO, Colorado, Los angeles, MS, TN, CA) along with most states in which we previously made loans (IL, KS, Los angeles, MN, Okay, Otherwise, WA, WY). Regarding widely known employers regarding payday loan users, these details place tend to echo the most significant companies within prominent locations, instance California.

81.2% of all payday loans readers on the LendUp has actually complete-time a position, and therefore they have to possess money going to repay their debts. More commonly, some one play with payday loan to afford timing mismatch having a cost arriving before the paycheck arrives to pay for they. For folks who create those people that is actually part-big date working, resigned, or thinking-used to individuals with complete-day work, your take into account 96.1% off pay day loan users. Merely 1.2% from pay day loan recipients are known as underemployed.

To start, why don’t we glance at the employment position of people that rating payday financing via LendUp

Within the application techniques, LendUp cash advance receiver report information on the community of a career. Next graph stops working loan receiver by world:

Typically the most popular community for in need of an instant payday loan try conversion process relevant. This may are merchandising workers otherwise sales agents concentrating on an effective fee having an erratic spend schedule. Another typical industry is some one doing work in work environment and you can management. Regarding note, the third most common class is healthcare related.

Lastly, why don’t we glance at the people most abundant in payday loans readers. As mentioned past, understand that these records reflects the employment feet inside areas where LendUp operates and this including huge employers will naturally appear with greater regularity with the below listing:

Walmart, the biggest boss in the us, ‘s the amount employer of payday loan recipients as a result of LendUp. Record was ruled by the merchandising companies, in addition to health care, education, and you will regulators.

Inside investigation, we have found the most out of payday loan receiver is actually operating regular. Despite making a normal money, expenditures developed that people don’t have the family savings stability to fund. Many of these anybody work in school, healthcare facilities, together with places which have offered extremely important attributes from the pandemic. Someone get cash advance to cover urgent expenses, as well as for of a lot Us americans, these on the web finance could be the just supply of capital readily available during the days of crisis or when monetary needs surpass available fund.